Supporting Business on the Journey to a Sustainable Future

Founded in 2014, Datamaran is the market leader in Smart ESG software harnessing the power of AI to support businesses in environmental, social, and governance decision-making, strategy-setting, and ongoing management. Datamaran is used by the world’s most trusted brands to identify and prioritize issues material to their business, deepen their teams’ subject matter knowledge, monitor risks and opportunities, and take control of their ESG strategy.

Much has been written about the death of ESG in recent months, especially in the context of investment decision-making but, in reality, there’s never been a more crucial time for business leaders to focus on the most relevant and important environmental, social, and governance issues for their companies. The good news is, that wherever your company is on its ESG journey, there are software solutions that can support you and enable you to manage the many facets of the ESG successfully in-house.

Navigating the Evolving ESG Landscape

Every company has its role to play in making the world a better, richer, healthier, fairer, and greener place. But knowing which ESG issues to prioritize and goals to incorporate into your sustainability plans and policies to ensure you’re making a positive meaningful impact isn’t easy. And with companies coming under increased public scrutiny and regulatory pressure, the stakes are high if you get it wrong (or are perceived to have done so).

Multinational organizations have complex operations and supply chains to assess, multiple external stakeholder groups to engage, globally distributed internal teams to align, new unfamiliar data they now need to gather, quantify, calculate, and verify, and different standards and regulatory requirements across jurisdictions with which they may need to conform and comply.

Navigating the ESG landscape is certainly a challenge but one that companies must rise to for the good of our planet and people and to create long-term strategic value for their business and its shareholders.

Informed Decision-Making is Key to Success

Data is an integral component of ESG management. When it comes to implementing ESG strategies and setting goals, business leaders must make evidence-based, data-backed, and documented decisions to ensure their companies’ plans are tackling the most significant issues and are defensible as a result.

Conducting a double materiality assessment process is best practice and a legal requirement in some countries under the Corporate Sustainability Reporting Directive (CSRD) as it enables C-suite and senior management to understand the influence and impact of ESG issues from both the outside-in and the inside-out perspective so they can prioritize the most important ones and ensure business policies and practices are aligned accordingly.

Without robust and reliable data on which to base your decisions and plans, you risk them being subjective, biased, too broad, or too narrow in terms of the universe of ESG issues, all of which can lead to inadvertent greenwashing. Avoid this by ensuring you are gathering, analyzing, and acting upon data-backed insights from the outset as opposed to introducing ESG data management at the latter reporting and disclosure phase.

The Growing Importance of ESG Technology

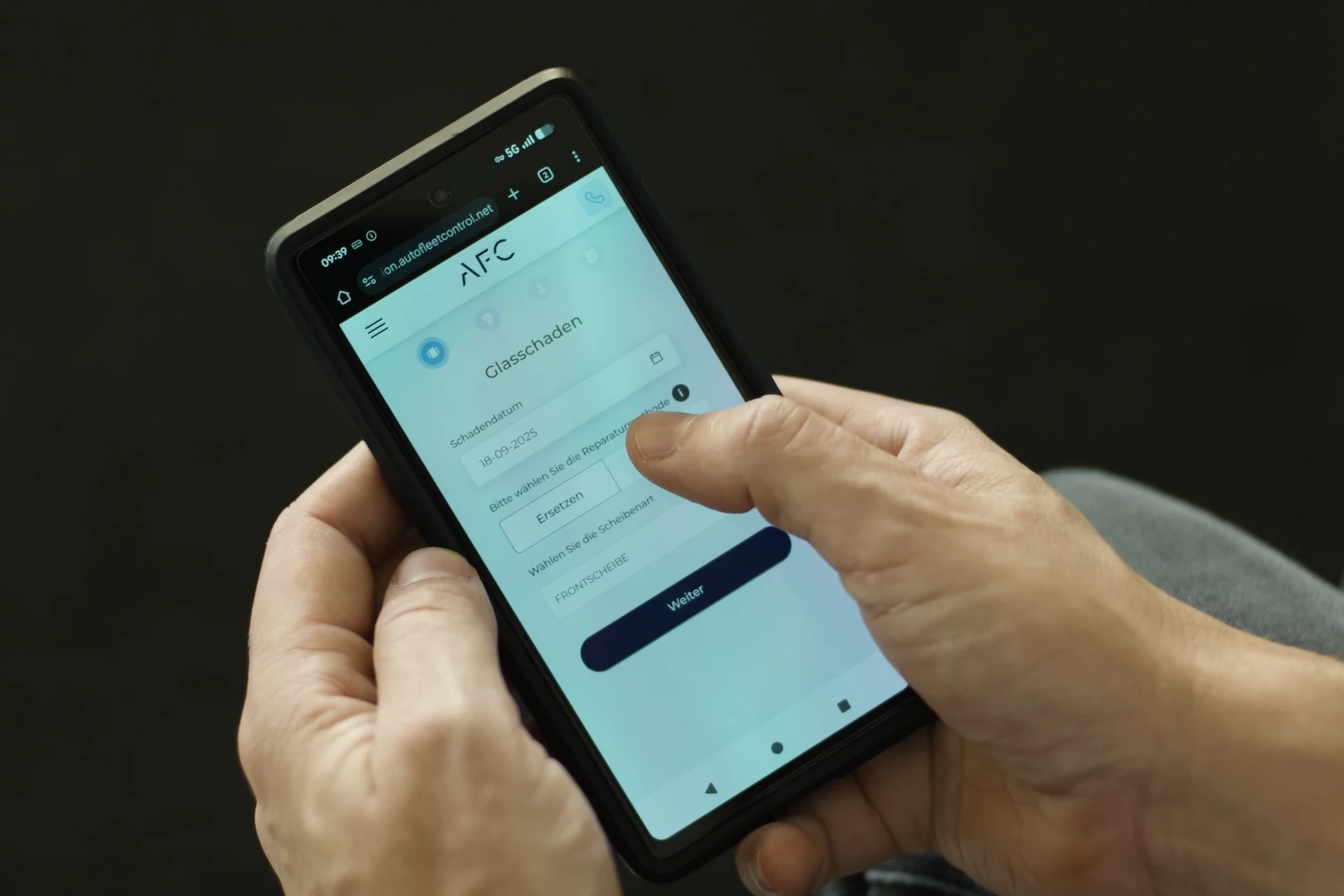

In today’s rapidly evolving ESG landscape, integrating technology into the ESG management process from the start is no longer an option but a necessity. Software solutions automate scalable, repeatable, and comprehensive workflows and processes for data gathering and analysis, providing critical decision-making insights that are simply not achievable through manual processes. The digitization of these processes ensures that companies can track, measure, and adapt to emerging issues and material risks and opportunities swiftly and efficiently.

Smart ESG software such as Datamaran is indispensable for companies at every stage of their ESG journey. In the early stages, it supports robust and data-driven materiality assessments, while in the latter stages, it ensures continuous monitoring, compliance, and adaptability in an ever-changing regulatory environment.

By using software to automate business-critical ESG processes, companies can create sustainability strategies and plans that have a positive meaningful impact on the world, stay ahead of emerging risks, meet regulatory demands, and deliver long-term value to stakeholders. That certainly sounds like a win-win situation to us.