Innovating in Impact Investment

Aligning interests to create shared value using blockchain

Kula originated from a dream propelled by the conviction that blockchain’s potential could instigate a ground-breaking shift towards a more equitable distribution of wealth and prosperity in developing contexts.

From this inception, Kula has crafted a business model that harmonises the interests of diverse groups, creating shared value.

In an economic landscape where conflicting interests have the potential to erode trust and compromise the societal fabric, the realisation of shared prosperity is impeded. Addressing misaligned interests presents a transformative opportunity to generate and allocate value.

Kula facilitates its impact investment model by setting up regional projects as Decentralised Autonomous Organization blockchain-enabled structures, or DAOs. We invest in real-world assets and collaborate with each stakeholder using the DAO structure to align different interests. Without a central authority, decision-making is distributed among members who vote on proposals using tokens that are executed by smart contract.

Governance tokens are issued to each group incentivising active participation in proposals and decisions that shape collective outcomes. As trust among stakeholders deepens, latent value is unlocked. A robust governance protocol ensures regulatory compliance, and investor confidence, to create a transparent partnership between investors, asset developers, and local stakeholders.

With success at the regional level, Kula extends this approach collectively to create a double-DAO structure. This framework creates a diverse portfolio of real-world assets, allowing transparency and accountability in funding allocation. Tokenising the governing rights and assets provides stakeholders with a say in shaping Kula’s future and ensures an immutable floor value for their investment. Kula’s token value reflects both the tokenized governing rights and the assets themselves.

In 2022, Kula partnered with Bekazulu Mining Limited (BML) in Zambia to develop a limestone asset as its first RegionalDAO. Kula’s investment helped BML sustain and expand production.

As a DAO, governance rights and the related asset value are shared with community stakeholders and staff. This partnership led to the identification of a new water source, benefiting a nearby water distressed community and catalysed innovative agricultural development. The beneficiary community is now engaged in agricultural activities throughout the year and is supplying fresh produce to the immediate locality.

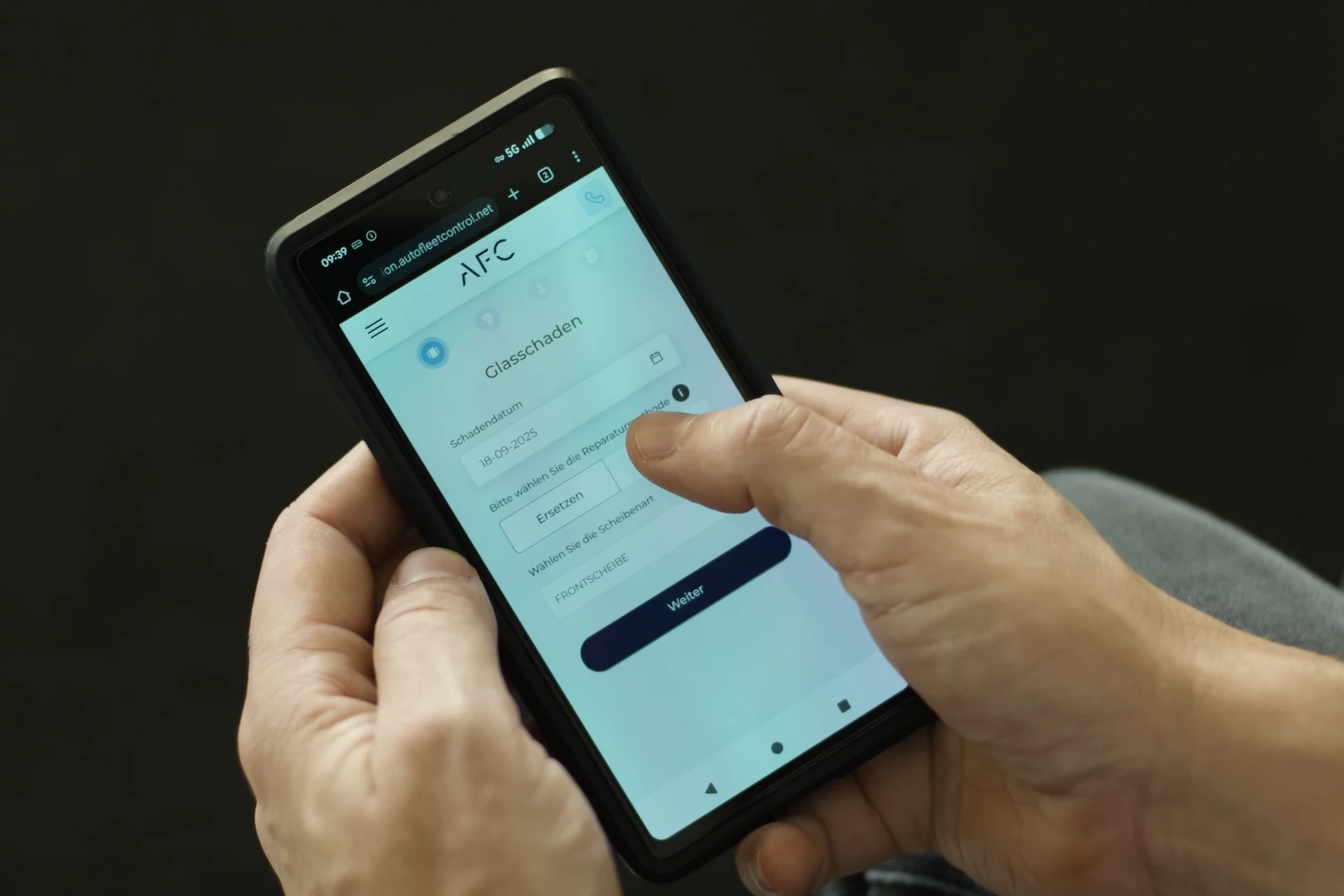

With Kula’s app on their smartphone each DAO member can participate in real time decision making over the asset(s) that impacts their life. Stakeholders of BML have chosen an above-average wage for the region and equal pay for men and women.

Reflected value in token supply for each token holder can be leveraged to release the capital required to catalyse new micro economic opportunities that impact the immediate locality. This presents a challenge of governance. DAOs offer an opportunity for innovative governance that eliminates hierarchy and streamlines efficiency.

However, there is also value in proven centralised governance models. Because Kula manages real-world assets it strives for decentralised governance with a unique triangulated decision-making structure within its protocol to balance this tension. This approach addresses the governance limitations of the technology with checks and balances that safeguard stakeholders’ interests with appropriate accountability for regulators and investors.

Kula plans ICO in early 2024.